Are You New To Us?

Who We Are And What We Do

We're travel journalists who connect travelers with the best trip planner for their specific goals and needs.

We're travel journalists who connect travelers with the best trip planner for their specific goals and needs.

What's a WOW trip

It's a private trip, custom-tailored to your unique interests, that maximizes all aspects of the experience and minimizes crowds, lines, and logistics.

It's a private trip, custom-tailored to your unique interests, that maximizes all aspects of the experience and minimizes crowds, lines, and logistics.

How to get a WOW trip

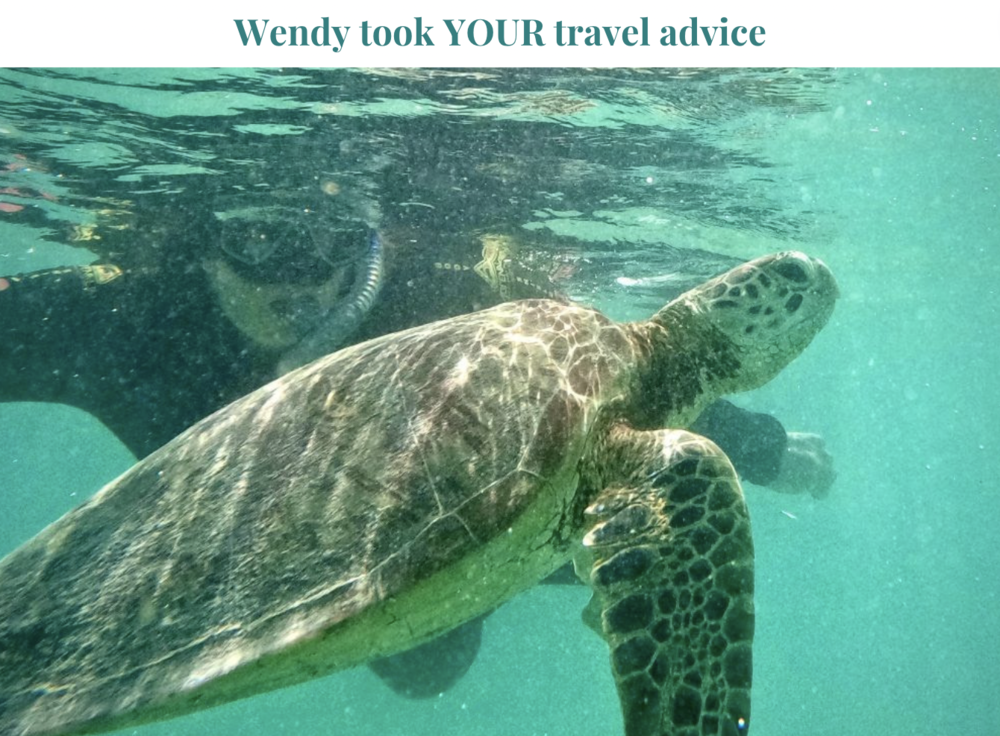

Wendy has built a system on behalf of, and by popular demand from, her longtime readers. Here's the proof that it works.

Wendy has built a system on behalf of, and by popular demand from, her longtime readers. Here's the proof that it works.

GET A PERSONALIZED TRIP RECOMMENDATION